VAT refunds on self-build homes

Self-build homes and the conversion of non-residential buildings into dwellings may qualify to reclaim the VAT paid on eligible building materials and services. The building must not be intended to be used for business purposes.

The refund applies whether the home owner carries out the building work themselves, or whether they use builders to do some, or all of the work for them. Refunds are also permitted where the home owner adds to or finishes a partly completed new building, but not for extra work carried out on a completed building.

Claims to HMRC can only be made once the construction is finished. Completion can be demonstrated by:

- A certificate or letter of completion from the local authority for building regulations purposes.

- A habitation certificate or letter from the local authority.

- A valuation rating or council tax assessment.

- A certificate from a bank or building society.

Claims must be made within three months of completion and refunds will normally be made within 30 banking days of receiving the claim.

Making a claim requires that VAT invoices have been obtained and that they are correct. VAT invoices must show:

- The supplier's VAT registration number.

- The quantity and description of the goods and/or services.

- The purchaser’s name and address if the value is more than £100.

- The price of each item.

It is much easier to collect, collate and process the appropriate paperwork as project progresses than it is to try to do so after the building is complete.

Claims can be made for:

- Building materials or goods incorporated into the building or conversion itself, or into the site (that is materials or goods that cannot be removed without using tools and damaging the building or the goods themselves). Exceptions include; fitted furniture, some electrical and gas appliances, and carpets or garden ornaments.

- If you are converting a non-residential building into a home, you can reclaim the VAT charged by your builder. For conversions, a builder can sometimes charge you a reduced rate instead of the standard rate of VAT.

Builder's services for new buildings should be zero-rated for VAT.

VAT paid on any professional or supervisory services cannot be reclaimed (although in kit houses this may be wrapped-up in the price of the kit), neither can VAT paid on services such as the hire of plant, tools and equipment.

[edit] Related articles on Designing Buildings Wiki

- Business rates.

- Kit house.

- PAYE.

- Self build.

- Self-build home project plan.

- Self-build homes negotiating discounts.

- Self build initiative.

- Stamp duty.

- VAT

- VAT - Option to tax (or to elect to waive exemption from VAT).

- VAT - Protected Buildings.

[edit] External references

Featured articles and news

Shading for housing, a design guide

A look back at embedding a new culture of shading.

The Architectural Technology Awards

The AT Awards 2025 are open for entries!

ECA Blueprint for Electrification

The 'mosaic of interconnected challenges' and how to deliver the UK’s Transition to Clean Power.

Grenfell Tower Principal Contractor Award notice

Tower repair and maintenance contractor announced as demolition contractor.

Passivhaus social homes benefit from heat pump service

Sixteen new homes designed and built to achieve Passivhaus constructed in Dumfries & Galloway.

CABE Publishes Results of 2025 Building Control Survey

Concern over lack of understanding of how roles have changed since the introduction of the BSA 2022.

British Architectural Sculpture 1851-1951

A rich heritage of decorative and figurative sculpture. Book review.

A programme to tackle the lack of diversity.

Independent Building Control review panel

Five members of the newly established, Grenfell Tower Inquiry recommended, panel appointed.

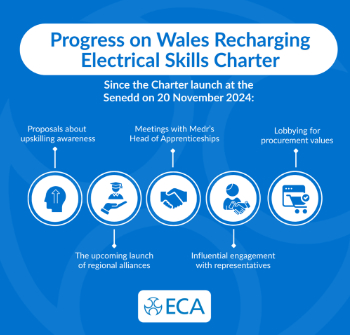

Welsh Recharging Electrical Skills Charter progresses

ECA progressing on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.